Inflation is a term that’s thrown around a lot, but what does it actually mean? In simple terms, inflation refers to the increase in prices of goods and services over time. While a little inflation is normal and even healthy for the economy, excessive inflation can erode purchasing power, making everyday life more expensive.

So why is inflation such a big deal in 2024? Post-pandemic recovery, geopolitical tensions, and supply chain disruptions have created a perfect storm for rising prices. Whether you’re an individual or part of a business, understanding how to combat inflation is essential. Let’s dive into the most effective ways to fight inflation this year.

Understanding Inflation

The Basics of Inflation

Inflation is measured using indexes like the Consumer Price Index (CPI) or the Producer Price Index (PPI). These tools track changes in the prices of a basket of goods and services over time.

What causes inflation? It can stem from:

- Demand-pull inflation: Too much money chasing too few goods.

- Cost-push inflation: Rising costs for production leading to higher prices.

- Built-in inflation: Businesses increase wages to match price increases, which leads to further inflation.

Current Inflation Trends in 2024

In 2024, inflation is being influenced by global factors like energy shortages, rising commodity prices, and shifts in international trade. Certain sectors, such as housing and healthcare, have been particularly affected.

Effective Ways to Combat Inflation

Personal Finance Strategies

Creating a Budget

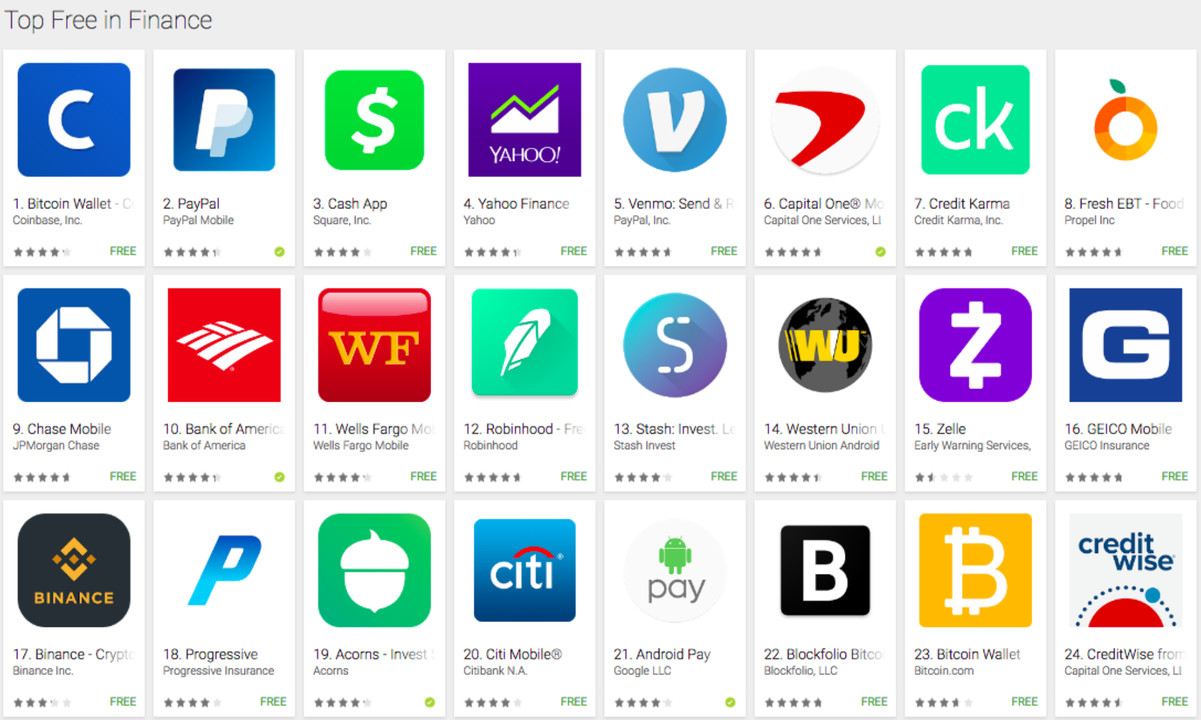

A detailed budget helps you understand where your money is going. Categorize your spending and cut down on non-essential expenses. Apps like Mint or YNAB can be a lifesaver.

Prioritizing Savings

Saving is tougher when prices rise, but it’s essential. Focus on building an emergency fund to cushion the impact of unexpected expenses. High-yield savings accounts can also help your money grow despite inflation.

Paying Down Debt

Inflation can make borrowing more expensive. Tackle high-interest debt first to avoid paying more over time. Consider refinancing loans if better rates are available.

Smarter Investments

Investing in Inflation-Proof Assets

Gold, real estate, and Treasury Inflation-Protected Securities (TIPS) are popular choices. These assets tend to retain or increase in value during inflationary periods.

Diversifying Your Portfolio

Spreading investments across sectors and geographies reduces risk. A mix of stocks, bonds, and alternative investments can help you ride out market volatility.

Adjusting Spending Habits

Buying in Bulk and Seeking Discounts

Stocking up on non-perishable items during sales can save money in the long run. Utilize cashback apps and loyalty programs to stretch your dollar.

Energy and Utility Savings

Inflation often impacts utility bills. Simple steps like insulating your home, using energy-efficient appliances, and unplugging unused devices can lower costs.

Policy-Level Solutions

Government Strategies to Control Inflation

Monetary Policy Adjustments

Central banks can raise interest rates to reduce money supply, which helps curb inflation. This strategy, however, must be balanced to avoid slowing economic growth.

Fiscal Policy Interventions

Governments can also adjust spending and taxation to stabilize the economy. For example, offering subsidies for essential goods can reduce the burden on consumers.

Long-Term Approaches to Manage Inflation

Education and Financial Literacy

Teaching people how to manage money effectively can reduce the impact of inflation. Schools and community programs can play a vital role.

Building Resilient Systems

Encouraging innovation, improving supply chains, and diversifying energy sources are critical for long-term inflation control.

Conclusion

Inflation might feel like an uphill battle, but proactive steps can make a big difference. From budgeting and saving to investing wisely and advocating for policy changes, there are plenty of ways to protect your financial health. The key is to stay informed and adaptable.

FAQs

1. What is the difference between inflation and deflation?

Inflation is when prices rise, reducing purchasing power, while deflation is when prices fall, which can also hurt the economy by discouraging spending.

2. How can I protect my savings during inflation?

Invest in high-yield savings accounts, inflation-protected securities, or assets like gold and real estate.

3. Are there specific industries that benefit from inflation?

Yes, sectors like energy, commodities, and real estate often see gains during inflationary periods.

4. Can inflation ever be a good thing?

Moderate inflation encourages spending and investment, which can drive economic growth.

5. What are the best tools to track inflation trends?

The Consumer Price Index (CPI), Producer Price Index (PPI), and reports from central banks are reliable sources.