Starting or expanding a business often requires additional capital, and that’s where business loans come into play. Business loans provide entrepreneurs with the financial resources they need to achieve their goals, whether it’s launching a startup, purchasing equipment, or managing daily operations. But how do you secure a business loan in the USA? Let’s dive into the details.

Types of Business Loans

Term Loans

Term loans are one of the most common types of business loans. They are available in two main forms:

- Short-term loans: Ideal for immediate expenses, these loans are typically repaid within a year or two.

- Long-term loans: These loans are suitable for major investments and can have repayment periods ranging from three to 25 years.

Small Business Administration (SBA) Loans

SBA loans are government-backed loans that offer favorable terms for small businesses. Popular programs include:

- 7(a) Loan Program: A versatile option for various business needs.

- 504 Loan Program: Focused on purchasing fixed assets like real estate and equipment.

Equipment Financing

Need new machinery or tools? Equipment financing can help. The loan is secured against the equipment you purchase, making it easier to qualify even if your credit score isn’t perfect.

Business Lines of Credit

A business line of credit works much like a credit card, providing flexibility for ongoing expenses. It’s perfect for businesses that experience seasonal cash flow fluctuations.

Merchant Cash Advances

This type of funding allows you to borrow against future sales. While convenient, it often comes with higher costs, so proceed with caution.

Key Requirements for Business Loan Approval

Credit Score

Lenders heavily rely on your credit score to assess risk. Aim for a score of at least 650, although some lenders may accept lower scores.

Business Plan

A detailed business plan demonstrates your vision and strategy, giving lenders confidence in your ability to repay the loan.

Financial Statements

Up-to-date financial records, including income statements, balance sheets, and cash flow statements, are crucial for evaluating your business’s health.

Steps to Apply for a Business Loan

- Research Loan Options: Compare terms, interest rates, and repayment periods.

- Prepare Documentation: Gather essential documents, including tax returns and a business plan.

- Submit the Application: Follow the lender’s specific requirements to ensure a smooth process.

Top Lenders for Business Loans in the USA

Banks

Traditional banks offer competitive rates but may have stricter eligibility criteria.

Credit Unions

These member-owned institutions often provide more personalized service and better rates.

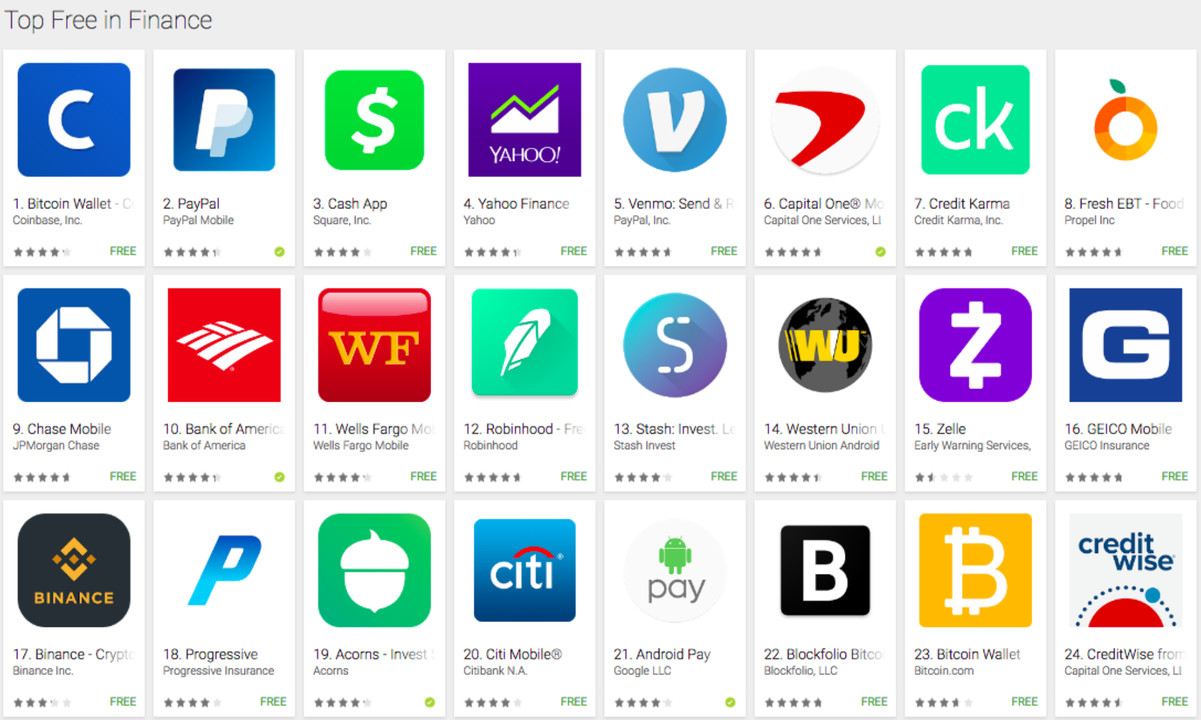

Online Lenders

Fast and convenient, online lenders are a popular choice for small businesses looking for quick approvals.

Benefits of Business Loans

- Scaling Your Business: Expand operations or enter new markets.

- Maintaining Cash Flow: Cover operational expenses during slow periods.

- Unforeseen Expenses: Handle emergencies without depleting reserves.

Challenges in Getting a Business Loan

- High-Interest Rates: Particularly for borrowers with lower credit scores.

- Strict Eligibility Criteria: Not all businesses will qualify, especially startups.

Tips for Increasing Loan Approval Chances

- Build Strong Credit: Pay debts on time and keep credit utilization low.

- Provide Collateral: Assets like property or equipment can secure better terms.

Alternatives to Traditional Business Loans

Crowdfunding

Platforms like Kickstarter allow businesses to raise funds directly from supporters.

Angel Investors

These individuals invest in startups in exchange for equity or convertible debt.

Conclusion

Business loans are a vital tool for entrepreneurs in the USA. By understanding the types, requirements, and application process, you can secure the funding you need to achieve your business goals. Remember to research thoroughly and choose the option that best suits your needs.

FAQs

- What is the minimum credit score for a business loan?

Most lenders require a credit score of 650 or higher, but some options are available for lower scores. - How long does it take to get a business loan approved?

Approval timelines range from a few days with online lenders to several weeks for traditional banks. - Are there business loans for startups?

Yes, SBA loans and microloans are tailored for startups. - Can I get a business loan with bad credit?

While challenging, options like secured loans or merchant cash advances may be available. - What happens if I can’t repay a business loan?

Failing to repay can damage your credit and may result in asset seizure if the loan is secured.