Managing your finances in 2025 is more critical than ever. With evolving technology, unpredictable economic trends, and rising living costs, staying on top of your money is no longer optional—it’s essential. So, how can you navigate this financial maze? Let’s explore the steps you can take to secure your financial future.

Understanding Your Financial Situation

Assessing Income and Expenses

Start by evaluating your income sources and listing all expenses. Categorize them into fixed (like rent) and variable (like dining out) to get a clearer picture.

Tracking Spending Habits

Use tools like digital banking apps or spreadsheets to monitor where your money goes. Awareness is the first step toward better financial control.

Creating a Financial Plan

Setting Short-Term and Long-Term Goals

Identify what you want to achieve financially. Short-term goals might include paying off a credit card, while long-term goals could involve buying a house or retiring comfortably.

Importance of an Emergency Fund

Aim to save three to six months’ worth of living expenses in a separate account for unforeseen events like medical emergencies or job loss.

Leveraging Technology for Financial Management

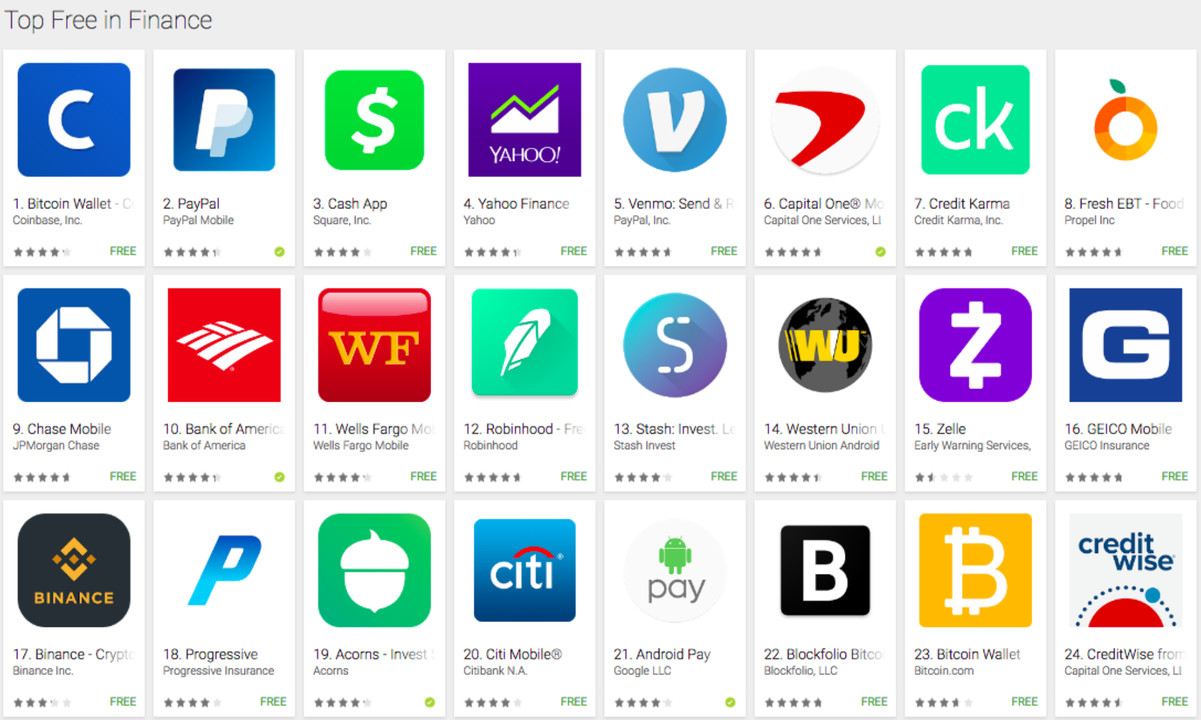

Budgeting Apps

Tools like Mint, YNAB (You Need a Budget), or newer apps with AI features can simplify budgeting and provide real-time insights into your finances.

Digital Banking Tools

Banks now offer advanced online tools, such as goal-based savings accounts, expense categorization, and AI-driven financial advice.

Investing Wisely

Popular Investment Options in 2025

- Index Funds and ETFs: Reliable and low-cost options.

- Cryptocurrencies: Still popular, but approach with caution.

- Green Investments: Sustainable funds are gaining traction.

Risk Management Strategies

Diversify your portfolio to spread risk across asset types and industries. Avoid putting all your eggs in one basket.

Managing Debt Effectively

Prioritizing High-Interest Debt

Focus on paying off debts with the highest interest rates first, such as credit card balances, to minimize costs.

Strategies for Debt Consolidation

Consider consolidating debts into a single loan with a lower interest rate to simplify payments and save money.

Building and Maintaining Credit

Importance of a Good Credit Score

A high credit score can save you thousands in interest on loans and make it easier to rent apartments or secure jobs.

Tips for Improving Your Credit in 2025

- Pay bills on time.

- Keep credit utilization below 30%.

- Check your credit report regularly for errors.

Planning for Retirement

Benefits of Starting Early

The earlier you start saving, the more time your money has to grow due to compound interest.

Modern Retirement Accounts

Look into options like 401(k)s, IRAs, and even Health Savings Accounts (HSAs) for tax advantages.

Saving for Major Expenses

Setting Up Savings Plans

Use high-yield savings accounts or investment accounts to save for significant expenses like college tuition or a down payment on a house.

Automating Savings

Set up automatic transfers to your savings account to ensure consistency.

Adapting to Economic Changes

Navigating Inflation and Recession Risks

Keep a portion of your portfolio in assets that traditionally outperform during inflation, like real estate or gold.

Diversifying Income Streams

Consider side hustles or freelancing to supplement your primary income.

Seeking Professional Guidance

Working with Financial Advisors

A certified financial planner can help tailor strategies to your unique financial situation and goals.

Utilizing Online Resources

Free resources like blogs, webinars, and podcasts offer valuable financial tips and updates.

Teaching Financial Literacy

Educating Family Members

Ensure your family understands budgeting, saving, and investing basics to build generational wealth.

Tools for Teaching Kids About Money

Use kid-friendly apps or games to introduce concepts like saving and smart spending.

Sustainability and Ethical Spending

Choosing Eco-Friendly Investments

Invest in companies that prioritize sustainability and have a proven track record of social responsibility.

Minimizing Financial Waste

Adopt practices like energy-efficient upgrades and mindful spending to align your finances with ethical values.

Conclusion

Managing your finances in 2025 requires a blend of traditional strategies and modern tools. By understanding your financial situation, leveraging technology, and planning for the future, you can achieve your financial goals and secure your future.

FAQs

- What’s the best budgeting app for 2025?

Apps like YNAB and Mint are excellent, but explore newer apps with AI for personalized insights. - How can I save effectively during high inflation?

Focus on high-yield savings accounts and assets like real estate that keep pace with inflation. - Should I invest in cryptocurrencies in 2025?

Cryptocurrencies can be lucrative but remain volatile. Only invest what you can afford to lose. - What’s the ideal percentage of income to save?

Aim to save at least 20% of your income, divided among savings, investments, and retirement. - Is hiring a financial advisor worth it?

Yes, especially for complex financial situations. A good advisor can save you time and money.