1. Introduction

Financial management has always been a crucial skill, but in 2024, it takes on new dimensions due to global economic shifts, technological advancements, and changing lifestyles. Whether you’re looking to build wealth, reduce debt, or simply maintain financial stability, managing your finances effectively is key to achieving your goals. This article will guide you through the best practices, tools, and strategies to manage your finances in 2024, from setting goals to leveraging the latest technology.

2. Setting Financial Goals

Importance of Goal Setting

Setting clear financial goals is the foundation of good financial management. Without specific targets, it’s easy to lose track of your spending, saving, and investing efforts. Goals give you direction, helping you make informed decisions that align with your long-term objectives.

Short-term vs. Long-term Goals

Financial goals can be categorized into short-term and long-term objectives. Short-term goals might include saving for a vacation, paying off a credit card, or building an emergency fund. Long-term goals typically involve bigger financial commitments, such as buying a home, saving for retirement, or funding a child’s education. Understanding the difference helps you prioritize and allocate resources effectively.

SMART Goals Framework

Applying the SMART criteria—Specific, Measurable, Achievable, Relevant, and Time-bound—can make your financial goals more attainable. For example, instead of saying, “I want to save money,” a SMART goal would be, “I want to save $5,000 for an emergency fund within the next 12 months.” This specificity helps you stay focused and track your progress.

3. Budgeting Strategies

Creating a Monthly Budget

A monthly budget is one of the most effective tools for managing your finances. Start by listing all your sources of income and categorizing your expenses into fixed (e.g., rent, utilities) and variable (e.g., groceries, entertainment) costs. Allocate a portion of your income to savings and investments before budgeting for discretionary spending. This “pay yourself first” approach ensures that you prioritize financial security.

Tracking Expenses

Tracking your expenses is essential to maintaining control over your budget. Tools like expense-tracking apps or even a simple spreadsheet can help you monitor where your money goes. By regularly reviewing your spending habits, you can identify areas where you might be overspending and make adjustments accordingly.

Adjusting Budgets Based on Income Changes

Life is unpredictable, and so is your income. Whether you receive a raise, switch jobs, or experience a temporary loss of income, it’s important to adjust your budget to reflect these changes. Increase your savings contributions when your income rises, and cut back on non-essential expenses if your income decreases.

4. Saving and Investing

Importance of Emergency Funds

An emergency fund is a financial safety net that covers unexpected expenses, such as medical bills, car repairs, or job loss. Aim to save at least three to six months’ worth of living expenses in a liquid, easily accessible account. This fund can prevent you from going into debt when unexpected costs arise.

Long-term Investment Strategies

Investing is crucial for building wealth over time. In 2024, traditional investments like stocks, bonds, and real estate continue to be popular. Diversifying your investment portfolio can help manage risk and improve returns. Consider investing in index funds or exchange-traded funds (ETFs) for broad market exposure at a lower cost.

Sustainable and Ethical Investing

As awareness of environmental and social issues grows, many investors are turning to sustainable and ethical investing. These investment strategies focus on companies that prioritize environmental, social, and governance (ESG) factors. While these investments may offer competitive returns, they also allow you to align your portfolio with your values.

5. Managing Debt

Understanding Different Types of Debt

Not all debt is created equal. Good debt, such as a mortgage or student loans, can help you build wealth or improve your earning potential. Bad debt, like high-interest credit card debt, can quickly spiral out of control if not managed properly. Understanding the difference is key to making smart borrowing decisions.

Debt Repayment Strategies

Two popular debt repayment strategies are the snowball and avalanche methods. The snowball method involves paying off your smallest debts first, which can provide a psychological boost. The avalanche method focuses on paying off debts with the highest interest rates first, which can save you more money in the long run. Choose the method that best fits your financial situation and personality.

Refinancing and Consolidation

If you’re struggling with high-interest debt, refinancing or consolidating your loans might be a good option. Refinancing involves taking out a new loan with a lower interest rate to pay off existing debt, while consolidation combines multiple debts into a single loan with a lower interest rate. Both options can simplify your payments and reduce your overall interest costs.

6. Credit Management

Importance of Credit Score

Your credit score is a critical factor in determining your financial opportunities. A high credit score can qualify you for lower interest rates on loans and credit cards, saving you money over time. Regularly check your credit report to ensure accuracy and identify areas for improvement.

Ways to Improve Credit Score

Improving your credit score involves paying your bills on time, reducing your credit card balances, and avoiding new credit inquiries. It’s also important to maintain a mix of credit types, such as credit cards, auto loans, and mortgages, to demonstrate your ability to manage different kinds of debt.

Avoiding Common Credit Mistakes

Common credit mistakes include maxing out your credit cards, missing payments, and applying for too many new accounts in a short period. These actions can significantly harm your credit score and make it harder to obtain financing in the future. By managing your credit responsibly, you can avoid these pitfalls.

7. Retirement Planning

Starting Early

Starting your retirement planning early is one of the most effective ways to ensure a comfortable future. The earlier you begin saving and investing, the more time your money has to grow. This is due to the power of compound interest, which means you earn interest not only on your initial investment but also on the interest that accumulates over time. Setting aside even small amounts regularly can lead to significant savings by the time you retire.

Understanding Retirement Accounts

In 2024, understanding the various types of retirement accounts is crucial. Key options include:

- 401(k): Offered by employers, often with a matching contribution. Contributions are made pre-tax, reducing your taxable income, and grow tax-deferred until retirement.

- IRA (Individual Retirement Account): Allows for tax-deferred growth. You can choose between a traditional IRA (with pre-tax contributions) or a Roth IRA (with after-tax contributions and tax-free withdrawals in retirement).

- Roth 401(k): Similar to a traditional 401(k), but with after-tax contributions. Withdrawals are tax-free in retirement.

Each account has its own rules regarding contributions, withdrawals, and tax implications. Choosing the right type of account depends on your current financial situation and retirement goals.

Estimating Retirement Needs

Estimating how much you’ll need in retirement involves considering factors like your desired lifestyle, healthcare costs, and inflation. Use retirement calculators to estimate your future needs based on your current savings rate, expected rate of return, and retirement age. Adjust your savings plan accordingly to meet your target.

8. Tax Planning

Importance of Tax Planning

Effective tax planning helps you minimize your tax liabilities and maximize your refunds. By understanding the tax implications of your financial decisions, you can make choices that benefit your overall financial health. Tax planning involves strategies such as tax-loss harvesting, charitable giving, and investing in tax-advantaged accounts.

Tax-Advantaged Accounts

Tax-advantaged accounts offer benefits such as tax deductions, deferred taxes, or tax-free withdrawals. Examples include:

- Health Savings Accounts (HSAs): Allow for tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

- Flexible Spending Accounts (FSAs): Similar to HSAs but with a use-it-or-lose-it rule for unused funds.

- 529 Plans: Provide tax-free growth and withdrawals for qualified education expenses.

Understanding these accounts can help you take advantage of their benefits and reduce your taxable income.

Common Tax Deductions and Credits

Familiarize yourself with common tax deductions and credits that can reduce your taxable income or increase your refund. Examples include:

- Mortgage Interest Deduction: Deduct the interest paid on your mortgage.

- Student Loan Interest Deduction: Deduct interest paid on qualifying student loans.

- Child Tax Credit: A credit for each qualifying child under age 17.

Review the latest tax laws to ensure you’re taking advantage of all available deductions and credits.

9. Insurance and Risk Management

Types of Insurance to Consider

Insurance is essential for managing risk and protecting your financial well-being. Key types include:

- Health Insurance: Covers medical expenses and is often required under law.

- Life Insurance: Provides financial support to beneficiaries in case of your death. Options include term life and whole life policies.

- Home Insurance: Protects against losses related to damage or theft of your home and its contents.

- Auto Insurance: Covers vehicle damage and liability in case of accidents.

Calculating Insurance Needs

To determine how much insurance you need, consider factors such as your income, debts, and assets. Online calculators can help you estimate the appropriate coverage levels for different types of insurance. Regularly review and update your insurance policies to ensure they meet your current needs.

Importance of Regular Insurance Reviews

Insurance needs can change due to life events such as marriage, having children, or buying a new home. Regularly review your policies to ensure they provide adequate coverage. Adjust your coverage as needed to reflect changes in your life and financial situation.

10. Using Technology to Manage Finances

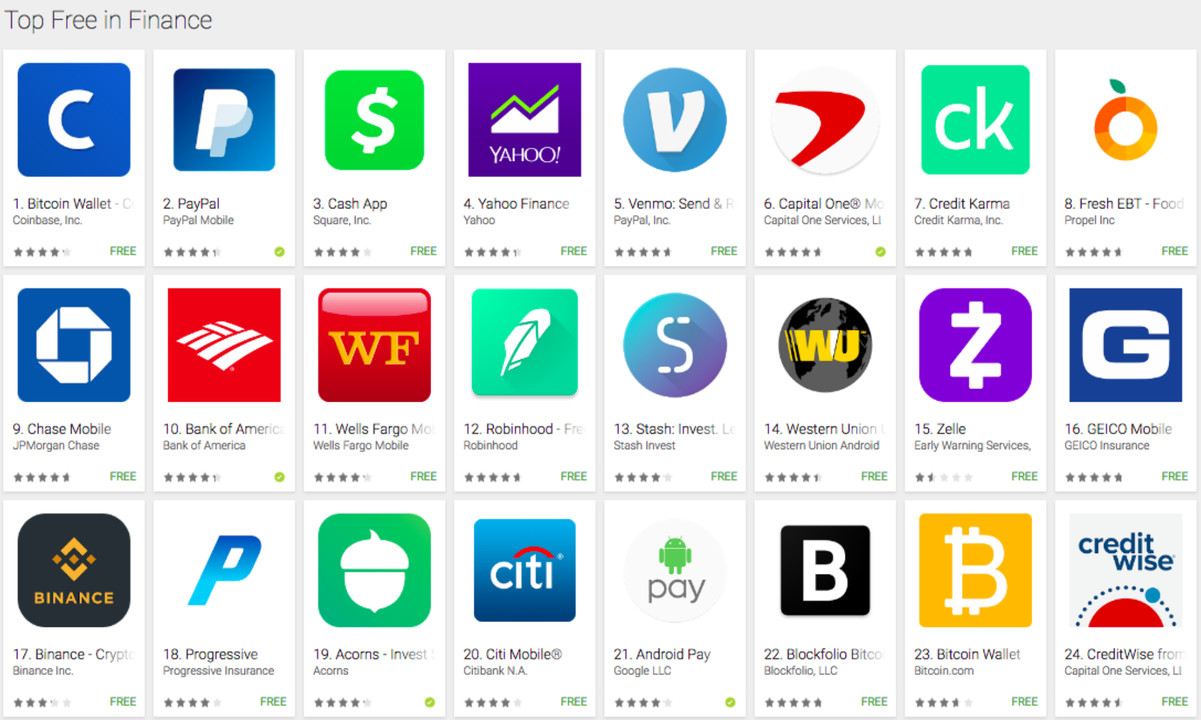

Financial Management Apps

In 2024, numerous financial management apps can help you track your spending, budget, and invest. Popular options include:

- Mint: Offers budgeting tools and expense tracking.

- YNAB (You Need A Budget): Focuses on proactive budgeting strategies.

- Personal Capital: Combines budgeting with investment tracking.

These apps can provide insights into your financial health and help you stay on top of your goals.

Automating Savings and Investments

Automating your savings and investments can simplify financial management and ensure consistent contributions. Set up automatic transfers to savings accounts or investment portfolios to build your wealth without needing to remember manual transactions.

Online Banking and Budgeting Tools

Online banking platforms and budgeting tools offer convenience and flexibility. Features such as bill pay, account alerts, and financial planning tools can help you manage your finances more efficiently. Choose platforms with robust security measures to protect your personal information.

11. Future Financial Trends

Emerging Trends in Personal Finance

Stay informed about emerging trends in personal finance to adapt to new opportunities and challenges. In 2024, trends such as digital currencies, financial technology advancements, and new investment options are shaping the financial landscape. Keeping up with these trends can help you make informed decisions and stay ahead of the curve.

Preparing for Economic Uncertainty

Economic uncertainty can impact your financial stability. Strategies to prepare include maintaining an emergency fund, diversifying investments, and staying informed about economic forecasts. Being proactive can help you navigate potential challenges and protect your financial future.

The Role of AI in Financial Management

Artificial intelligence (AI) is transforming financial management by offering advanced tools for budgeting, investing, and fraud detection. AI-powered platforms can provide personalized financial advice, analyze spending patterns, and identify investment opportunities. Embracing AI can enhance your financial decision-making and efficiency.

12. Expert Insights

Insights from Financial Experts

Financial experts provide valuable advice on managing finances effectively. For example, financial planner Jane Doe emphasizes the importance of early retirement planning and diversifying investments. Incorporating expert insights can enhance your financial strategy and decision-making.

Case Studies of Successful Financial Management

Examining case studies of individuals or families who have successfully managed their finances can offer practical lessons and inspiration. For instance, a case study on a couple who paid off significant debt and achieved financial independence highlights effective strategies and habits.

13. Conclusion

Recap of Key Points

Managing your finances in 2024 involves setting clear goals, creating and adjusting budgets, saving and investing wisely, and staying informed about financial trends. By applying the strategies discussed, you can achieve greater financial stability and work towards your long-term objectives.

Final Thoughts and Call to Action

Take control of your financial future by implementing the strategies outlined in this article. Start by setting realistic goals, using technology to streamline your financial management, and staying informed about emerging trends. The sooner you take action, the better prepared you’ll be for a secure financial future.

14. FAQs

How Can I Set Realistic Financial Goals?

To set realistic financial goals, assess your current financial situation, prioritize your objectives, and use the SMART criteria to make your goals specific, measurable, achievable, relevant, and time-bound. Regularly review and adjust your goals as needed.

What Are the Best Tools for Tracking My Spending?

Popular tools for tracking spending include Mint, YNAB (You Need A Budget), and Personal Capital. These apps offer features like expense tracking, budgeting, and financial insights to help you manage your money effectively.

How Much Should I Save in an Emergency Fund?

Aim to save three to six months’ worth of living expenses in an emergency fund. This amount provides a financial cushion to cover unexpected expenses such as medical bills, job loss, or major repairs.

What Are the Benefits of Automating Savings and Investments?

Automating savings and investments ensures consistent contributions, helps you stay disciplined, and can take advantage of compound interest over time. Automation simplifies financial management and reduces the risk of missing contributions.

How Can AI Improve My Financial Management?

AI can enhance financial management by offering personalized advice, analyzing spending patterns, detecting fraud, and identifying investment opportunities. AI-powered tools provide insights and recommendations tailored to your financial situation.