Finance apps are now key for managing money in our digital world. This article looks at the top 20 finance apps set to lead in 2024. They help make managing money easier, covering budgeting, tracking expenses, investing, and planning for the future.

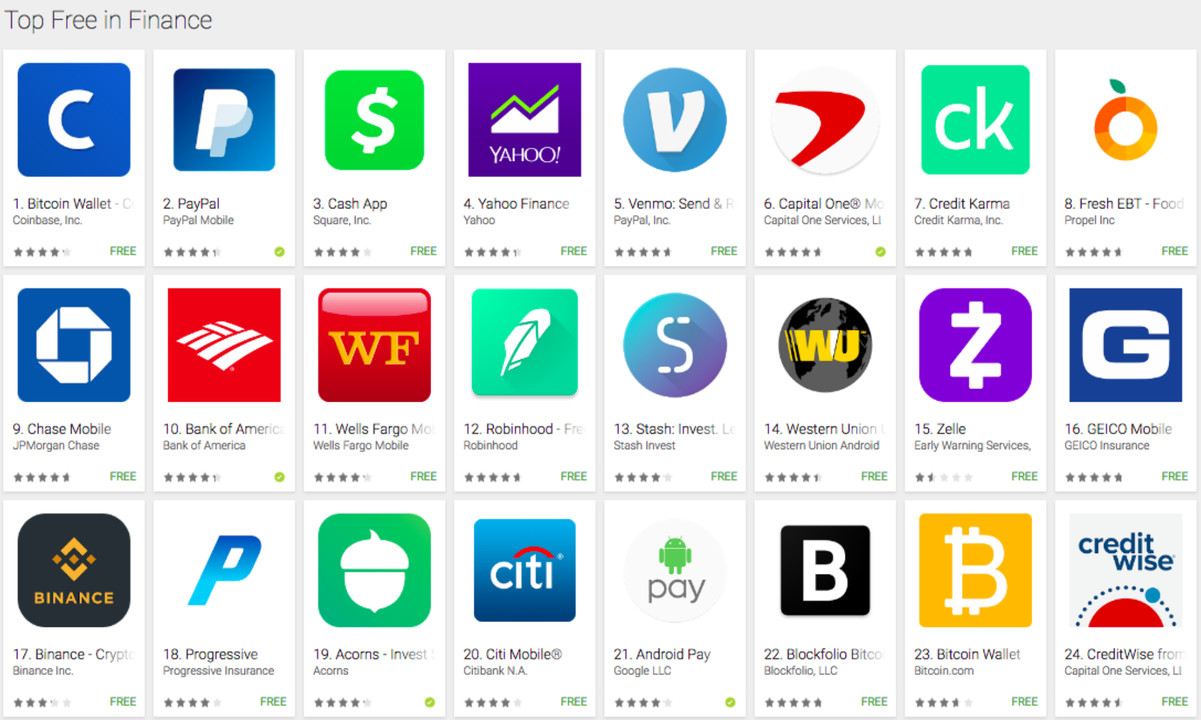

“An aerial view of a smartphone with multiple colorful icons representing the top 20 finance apps in 2024, arranged in a visually appealing pattern. Each icon displays a unique design and color scheme that reflects the app’s brand identity and purpose. The background is a gradient of shades of blue and green, creating an energetic and futuristic atmosphere.”

Table of Contents

Key Takeaways

- The finance app market is growing rapidly, with a focus on personalized solutions.

- Budgeting and expense tracking apps remain essential for maintaining financial control.

- Investment and wealth management apps are empowering individuals to take a more active role in their financial futures.

- Evaluating finance apps based on features, security, and user experience is crucial for finding the right fit.

- The top 20 finance apps in 2024 will offer a diverse range of tools to streamline personal and professional money management.

Introduction: The Rise of Finance Apps

The digital revolution has brought a new era of managing money. Finance apps are now key tools for both people and businesses. They offer great convenience, control, and insights into our financial health.

The Importance of Financial Management in the Digital Age

In today’s fast world, managing money well is more important than ever. Finance apps are the top choice for those wanting to manage their finances better. They give a clear view of income, expenses, savings, and investments. This helps users make smart choices and meet their financial goals.

How Finance Apps Have Revolutionized Money Management

Finance apps have changed how we handle money. They offer many features that make financial tasks easier, like automated budgeting and tracking expenses. They also help with managing investments and sending bill reminders. With real-time insights and advice, finance apps help us achieve financial stability and goals.

“Finance apps have become indispensable tools for individuals and businesses seeking to take control of their financial well-being in the digital age.”

The growth of finance apps is changing the financial world. They help with budgeting, tracking expenses, managing investments, and building wealth. These apps empower users to make smart financial decisions and reach their goals.

Top 20 Finance Apps in 2024

As 2024 approaches, the financial tech scene is set for a big change. The top 20 finance apps will offer tools to manage money better than ever. They cover everything from budgeting and tracking expenses to managing investments and planning for the future.

The year 2024 is shaping up to be exciting for finance lovers. New and easy-to-use apps will lead the way. They’ll make managing personal and business finances smoother with features like easy expense tracking and AI in investments.

Let’s dive into the key features and benefits of the top 20 finance apps expected to lead in 2024.

- Mint: A comprehensive budgeting and personal finance app that helps users track spending, create budgets, and monitor credit scores.

- YNAB (You Need a Budget): A popular budgeting app that focuses on the “envelope” method, helping users allocate their money efficiently.

- Acorns: An investment app that automatically invests users’ spare change, making it easy to build wealth over time.

- Robinhood: A commission-free trading platform that allows users to invest in stocks, ETFs, and cryptocurrencies.

- Personal Capital: A wealth management app that provides a holistic view of users’ finances, including investment portfolios and retirement planning.

| App Name | Key Features | Targeted Users |

|---|---|---|

| Mint | Budgeting, expense tracking, credit score monitoring | Individuals, families |

| YNAB | Envelope budgeting, goal-based savings | Individuals, couples |

| Acorns | Micro-investing, automated portfolio management | Beginners, millennials |

| Robinhood | Commission-free trading, cryptocurrency investing | Active investors, traders |

| Personal Capital | Wealth management, retirement planning, investment analysis | High-net-worth individuals, retirement savers |

These are just a few of the top 20 finance apps expected to lead in 2024. As the need for better financial management grows, we’ll see more innovative apps in the future.

“An array of colorful and sleek icons representing the top 20 finance apps in 2024, arranged in a geometric pattern that suggests connectivity and efficiency. The icons are arranged on a dark background that highlights their vibrant colors, and each one features a different symbol or image that represents its specific features.”

Budgeting and Expense Tracking Apps

Managing your money in today’s digital world is key. Budgeting and expense tracking apps are now essential for good financial health. They bring together features that help you understand your spending, manage your money better, and meet your financial goals.

Features to Look for in Budgeting Apps

Choosing the right budgeting app is crucial. Look for these important features:

- Easy-to-use interface for tracking and categorizing expenses

- Linking with bank accounts and credit cards for automatic updates

- Tools to analyze spending and find ways to save

- Customizable budgets and spending limits

- Alerts to keep you informed about your finances

Popular Budgeting Apps for 2024

Looking ahead to 2024, some budgeting apps will stand out for helping with expense tracking and financial control. Here are a few top picks:

- YNAB (You Need a Budget) – Offers an envelope budgeting system and deep financial insights

- Mint – Easy to use, it gives a full view of your finances and budget tips

- Personal Capital – A strong tool that combines budgeting apps with investment advice

These budgeting apps and expense tracking apps aim to give users the tools and insights for smart financial choices. They help you reach your financial goals.

Investment and Wealth Management Apps

In today’s world, apps for investing and managing wealth are key for planning your finances. They let you handle your investments, keep an eye on your portfolio, and make smart choices for your money. These apps are great for both new and seasoned investors, offering the tools and insights you need to reach your financial goals.

These apps stand out because they offer personalized investment advice. They look at your financial situation, how much risk you can take, and your goals. Then, they suggest investment options that fit you, helping you spread out your investments and increase your earnings. Plus, they give you updates on the market in real time, so you can make quick, informed decisions.

Another big plus of these apps is how easy they are to use and get to. They have simple interfaces and easy navigation, making it easy to keep an eye on your investments and finances anywhere. This is especially useful for people who are always on the go but still want to manage their money well.

| App | Key Features | Pricing |

|---|---|---|

| Betterment | Automated portfolio managementTax-loss harvestingRetirement planning tools | 0.25% – 0.40% annual fee |

| Wealthfront | Diversified investment portfoliosAutomatic rebalancingFinancial planning features | 0.25% annual fee |

| Fidelity | Comprehensive investment managementAccess to financial advisorsRetirement planning tools | Varies based on account type and services |

As managing finances gets more complicated, apps for investing and managing wealth are a big help. They offer tailored advice, up-to-the-minute information, and are easy to use. These apps are changing how people handle their investments and wealth in the digital era.

Show a vibrant display of various investment apps, each with their unique color schemes and design elements. The apps should be arranged in a circular formation, symbolizing the endless possibilities and opportunities for wealth creation through investing. The center of the circle should be an icon representing the year 2024, indicating that these apps are the top performers in the finance industry, reflecting the fast-paced and dynamic nature of modern investing. The background should be a gradient of blue to green, representing financial stability and growth.

“Investment and wealth management apps have revolutionized the way I approach my finances. The personalized guidance and real-time data have been invaluable in helping me make informed decisions about my investments and long-term financial goals.”

Criteria for Evaluating Finance Apps

The digital world offers many finance apps, which can be both a help and a problem. When picking the best finance apps for your money, it’s key to have criteria that fit your financial goals and likes. Knowing what to look for helps you pick apps that will help you manage your money well.

Key Factors to Consider When Choosing Finance Apps

When looking at finance apps, remember these points to make smart choices:

- User-Friendliness: Choose an app with an easy-to-use interface. This lets you quickly get to and manage your money.

- Security and Privacy: Keeping your personal and financial info safe is crucial. Look for apps with strong security and privacy rules.

- Data Integration: Pick apps that work well with your financial accounts. This lets you see all your money info in one place.

- Functionality and Features: Check if the app has what you need, like budgeting, tracking expenses, managing investments, and paying bills.

- Customization and Personalization: The best apps let you customize them to fit your needs and likes.

- Customer Support: Good customer support is key, especially for financial matters.

Thinking about these factors helps you pick the right finance apps. The right apps can be a big help in reaching your financial goals. They can make managing your money easier and help you succeed financially.

| Criteria | Explanation |

|---|---|

| User-Friendliness | The app should have an intuitive and easy-to-navigate interface, allowing you to quickly access and manage your financial data. |

| Security and Privacy | The app should employ robust security measures and adhere to strict data privacy protocols to safeguard your personal and financial information. |

| Data Integration | The app should seamlessly integrate with your existing financial accounts, enabling you to view all your financial information in one centralized platform. |

| Functionality and Features | The app should offer features such as budgeting, expense tracking, investment management, and bill payment to meet your specific financial needs. |

| Customization and Personalization | The app should provide personalized features and customization options, allowing you to tailor the experience to your individual preferences. |

| Customer Support | The app should offer reliable and responsive customer support, especially when dealing with sensitive financial matters. |

Conclusion

The top finance apps of 2024 have changed how we handle money. They let us track spending, plan budgets, invest, and understand our finances better. These apps give us the power to manage our money well and make smart choices.

Choosing the right finance app is easy with our guide. We look for apps that are easy to use, keep your data safe, and have lots of features. If you want to improve your budgeting, find new investment chances, or get a better view of your money, these apps have what you need.

These apps show how important it is to use new technology to manage our money better. They open up new ways to track expenses and build wealth. Start your financial journey with confidence, knowing these apps will help you every step of the way.

FAQ

What are the top 20 finance apps in 2024?

In 2024, the top finance apps will help with managing money for both personal and work life. They offer tools for budgeting, tracking expenses, managing investments, and planning for wealth.

How have finance apps revolutionized money management?

Finance apps have changed how we handle our money. They make managing finances easy with smooth interfaces and tools that analyze spending. This helps us understand our spending and plan for the future.

What key features should I look for in a budgeting app?

When picking a budgeting app, look for features like easy expense categorization and real-time tracking. Also, check for personalized budget tools and the ability to connect with your financial accounts for a full view of your spending.

What are the best investment and wealth management apps for 2024?

For 2024, the best investment and wealth management apps will help you manage your portfolio and track investments. They are designed for both new and experienced investors. These apps aim to help you reach your financial goals.

What criteria should I use to evaluate finance apps?

When checking out finance apps, think about how easy they are to use, their security, how well they integrate with data, and their functionality. These factors will help you pick apps that meet your financial needs and preferences.